Running a small business is a whirlwind. Between managing customers, marketing, and actually doing the work you love, bookkeeping can feel like an afterthought—until tax season rolls around and you’re knee-deep in receipts, wondering where all your money went.

Trust me, I’ve seen it all. As a seasoned bookkeeper, I’ve worked with business owners who’ve made every bookkeeping mistake in the book. The good news? Most of these common bookkeeping mistakes are easily avoidable with a little know-how and the right systems in place. Let’s dive into the most common bookkeeping blunders and how you can sidestep them like a pro.

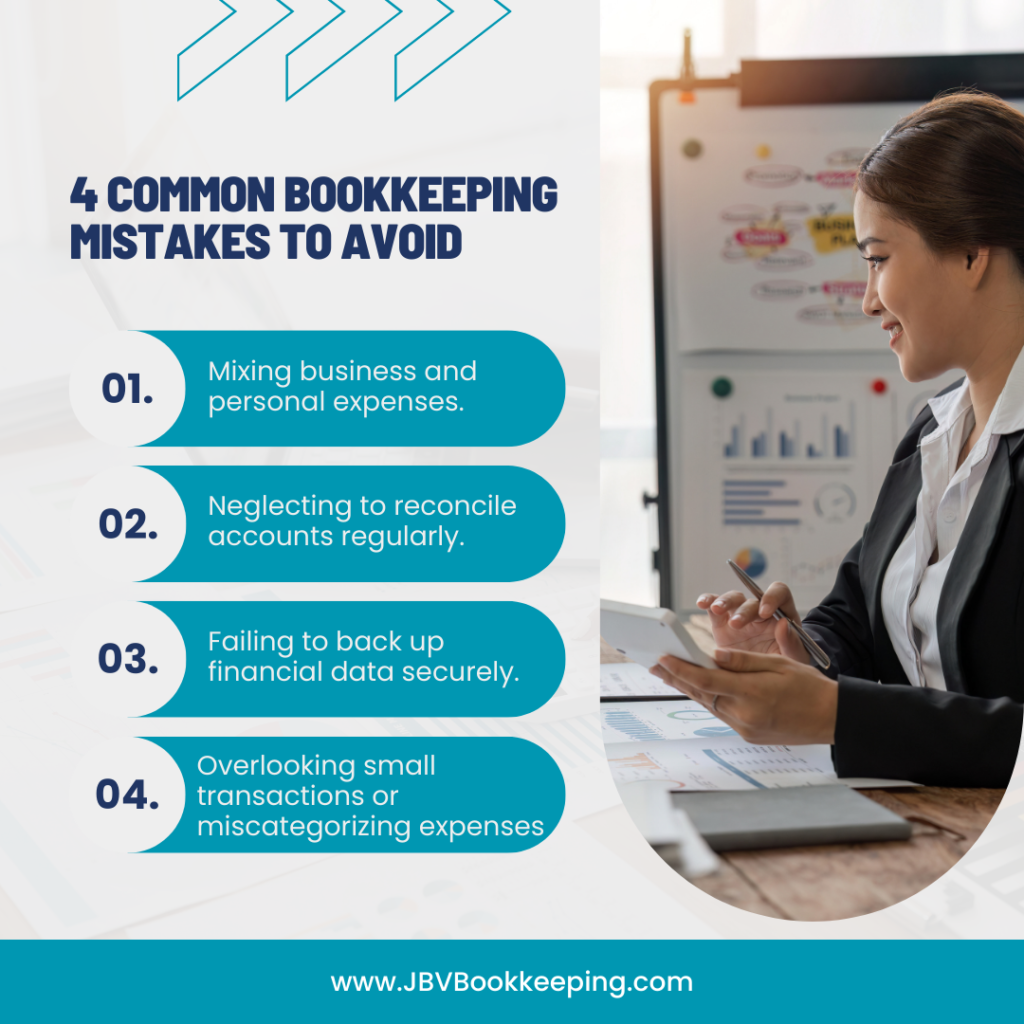

1. Mixing Personal and Business Finances

It’s tempting to use your personal bank account for business expenses, especially when you’re just starting out. But come tax time, untangling those transactions is a nightmare.

How to avoid it:

- Open a separate business bank account and credit card.

- Pay yourself a salary instead of dipping into business funds at random.

- Use bookkeeping software like QuickBooks Online to track business expenses.

2. Not Keeping Track of Receipts

You buy office supplies, take a client out for lunch, and grab some last-minute inventory. Then, months later, you realize you have no proof of these purchases.

How to avoid it:

- Use apps like Expensify or QuickBooks to snap photos of receipts.

- Set a routine (like every Friday) to organize and categorize expenses.

- Keep digital backups of all receipts.

3. Falling Behind on Reconciliation

Reconciling your bank statements is like balancing your checkbook—it ensures every transaction is accounted for. If you ignore this step, you might miss fraudulent charges, double payments, or accounting errors.

How to avoid it:

- Reconcile your accounts at least once a month.

- Use bookkeeping software to automate transaction matching.

- If reconciling makes your head spin, consider outsourcing it to a professional (schedule a free consultation here).

4. Forgetting to Record Cash Transactions

Cash transactions are easy to forget because there’s no digital footprint. But those small purchases add up, and missing them skews your financial reports.

How to avoid it:

- Always request a receipt for cash purchases.

- Record cash expenses immediately in your bookkeeping software or a simple spreadsheet.

- Consider using a petty cash log to track small expenses.

5. Not Categorizing Expenses Properly

Misclassifying expenses can lead to inaccurate financial reports and missed tax deductions.

How to avoid it:

- Use consistent, IRS-friendly categories (like “Office Supplies” instead of “Miscellaneous”).

- Review your chart of accounts regularly to ensure it makes sense for your business.

- If unsure, work with a bookkeeper to set up proper categories (check out our blog post on setting up a chart of accounts).

6. Ignoring Accounts Receivable

You did the work, sent the invoice, and… crickets. Not following up on outstanding invoices can kill your cash flow.

How to avoid it:

- Set up an invoicing system with automatic reminders.

- Establish clear payment terms upfront (e.g., “Due in 15 days”).

- Follow up on late payments consistently.

7. DIYing Bookkeeping for Too Long

Look, I get it—hiring a bookkeeper feels like an extra expense. But doing it all yourself can lead to costly mistakes, missed tax deductions, and hours of frustration.

How to avoid it:

- Outsource bookkeeping before you fall behind.

- Work with a professional who understands your industry.

- If you’re not ready to hire a bookkeeper, invest in a good bookkeeping course (like this course on Coursera).

Final Thoughts: Keep Your Books in Check

Avoiding these common bookkeeping mistakes will save you time, stress, and money. Whether you’re just starting out or have been in business for years, having clean financial records is key to making smart decisions and growing your business.

If bookkeeping isn’t your thing (or you just don’t have the time), let’s chat! I offer personalized bookkeeping services to keep your finances in check so you can focus on what you do best. Schedule a free consultation today or sign up for my newsletter for bookkeeping tips straight to your inbox!